With the recent changes in legislation for property investors, we have asked our friends at BMT Tax Depreciation to explain negative gearing, it’s benefits and things investors should consider when investing in property.

What is negative gearing?

While many people go into property investing thinking their investment will be an instant source of cash flow, this isn’t always the case.

Depending on the net income earned from a property, an investment property can be positively, neutral or negatively geared.

Neutral gearing is when the income earned from an investment property is the same as the total expenses, which may include mortgage repayments, maintenance costs, property management fees and other ongoing or one-off costs associated with owning an investment property.

In a situation where an investor is receiving a higher rental return than the outgoing expenses, the property will have positive cash flow and the owner will pay tax on this income earned.

By contrast, a negatively geared property has a rental income which is less than the outgoing expenses including deductible losses. Therefore, the property investor is making a cash loss on their investment.

This cash loss can be used to offset any income received, such as a salary, meaning that overall an investor with a negatively geared property will be required to pay less tax to the ATO.

As such, this is essentially using the taxation system to help offset the loss from an investment property.

For many, this is a short-term solution until an investment property can start making a positive cash flow.

However, this is a popular strategy for many Australian investors and some choose to remain negatively geared as part of a longer-term strategy.

As with any choice relating to an investment property, it’s important for investors to weigh up the pros and cons of this approach, in line with their individual investing goals.

Benefits of negative gearing

The benefits of negative gearing are hard to deny – it essentially turns a negative into a positive. Here are some of the main benefits of negative gearing:

- One of the biggest benefits is that it reduces taxable income, so you use these losses to offset your income and pay less tax as a result

- It can provide a financial boost in the short-term, which is particularly beneficial in the early years of owning an investment property when costs often outweigh income. As such, it makes it more viable to own an investment property.

- It can also offer longer-term success, allowing investors to take advantage of long-term capital gain as the value of their investment increases over time

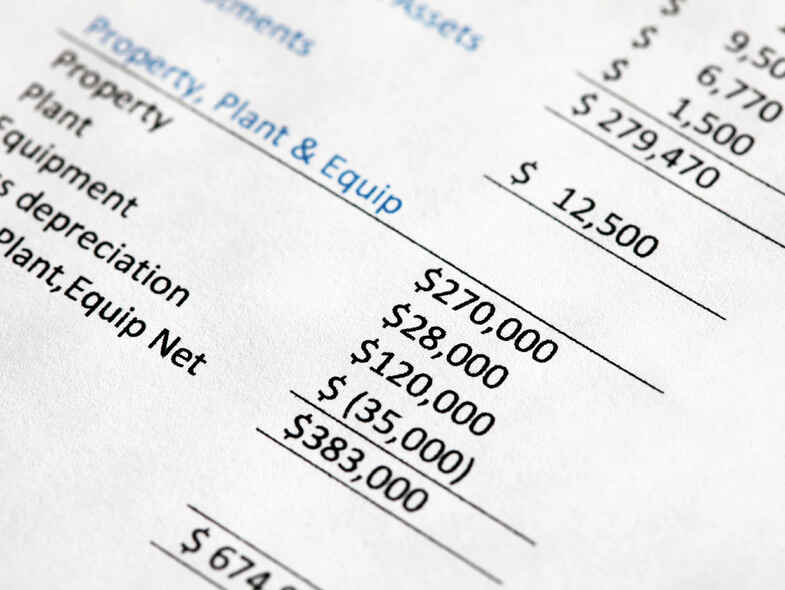

- Negative gearing entitles investors to a range of tax deductions including deductions for borrowing costs, advertising, insurance, capital works, depreciation of plant and equipment assets, council rates, water rates, repairs, maintenance, interest on loans, and many other expenses associated with owning an investment.

Things to look out for

Despite these undeniable benefits, there are a few things investors should consider:

- Although it reduces taxable income, a negatively geared investment property is still running at a loss. Investors should consider if they have the financial means to cover these losses each week, month and year, as well as for the entire period of time they plan to negatively gear

- Investors should consider the risk of their property decreasing in value, which could mean they’re unable to achieve the longer-term capital gain often associated with this strategy

- Investors who negatively gear should regularly evaluate the performance of their investment property to ensure that it will eventually make them money through the form of capital growth

- Investors who use this approach need to be disciplined with their finances and understand how negative gearing works

- There are some political considerations to take into account. On both sides of the political fence, there are ongoing arguments for and against negative gearing, as well as calls for changes to negative gearing legislation. Investors should consider how any future changes may affect their investment and financial position. Minor changes were made to negative gearing legislation in the 2017 federal budget, which you can read more about in BMT Tax Depreciation’s 2017 Budget Whitepaper.

Article provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS, AVAA) is the Chief Executive Officer of BMT Tax Depreciation. Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.