Buying an off-the-plan property is becoming increasingly popular in recent years with the release of many new suburbs and housing developments across the territory. But what does buying off the plan entail? From benefits and budget to location and lifestyle, here are the essentials to get you started.

Photography by Raphael Lovaski

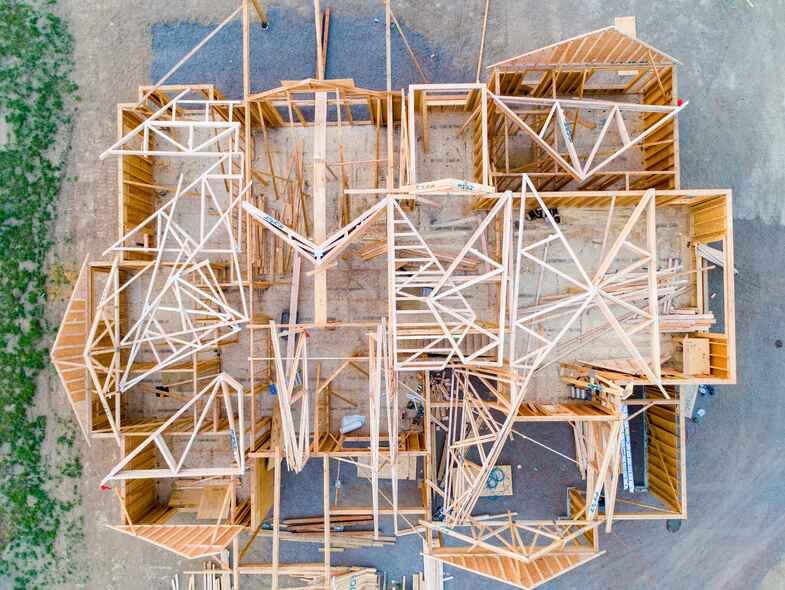

HOW IT WORKS

When you buy off the plan, you’re buying a property that hasn’t been built yet. That means you’re using drawings, floorplans, and computer-generated imagery to see what the finished home will look like, and then buying the home based on that information.

Photography by Evgeniy Surzhan

BUDGET

The first thing you need to know is your budget. If you’re not a cash buyer, it’s a good idea to speak to a bank or mortgage broker before you do anything. Sometimes there are restrictions or special requirements for off-the-plan homes, such as not being able to borrow as much as an established home, or needing a bigger deposit, so the sooner you start the conversation with a lender, the better.

Photography by Ryan Ancill

“When buying off the plan, set yourself some realistic expectations and prepare for any unforeseen delays, then consider anything less than that a bonus.”

Photography by Etienne Girardet

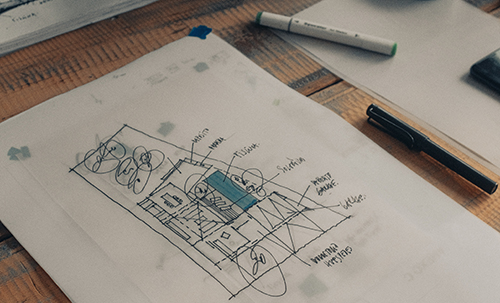

PLANNING

While you figure out your budget, you need to be clear with what you’re looking for in a property. Start by identifying your nice-tohaves and your deal breakers when it comes to layout, specification, location, lifestyle and how soon you want (or need) to move in. Then, use that information to create some pros and cons to help you decide if a brand-new or an established home is the better option for you.

RESEARCH

When buying off the plan, you won’t be able to visit the property you are looking to buy, so it’s important to research the building developer to make sure they are reputable and that you actually like the style of homes they build. If you’ve already got a specific development or home in mind, then carefully review the developer’s plans and timelines. It’s also a good idea to visit the area, as well as the site’s display home, if one is available, in order to get an idea of what your finished home might look like.

Photography by Immo Renovation

HIDDEN COSTS

When buying off the plan, you need to be prepared for hidden and unforeseen costs. Admittedly, one of the many benefits of buying off the plan is that you can often make upgrades to your kitchen, bathroom, flooring and fittings. However, be mindful that the high-end finishes you see in a display home might not come as standard in the home you want. This means that if you don’t ask the right questions, you might end up with a home that isn’t what you expected, and you might then have to spend thousands to change it. Finally, before you sign on the dotted line, be aware of the fine print and your rights when it comes to additional construction costs and lengthy delays.

TIMING

Another vital aspect of the home-buying process is timing. When buying an established home, you might only have to wait a few months before you can move in, but for an off-the-plan property, you might be waiting up to, or well over, a year, depending on the construction schedule. When buying off the plan, set yourself some realistic expectations and prepare for any unforeseen delays, then consider anything less than that a bonus. Timing is also relevant to your financial situation, so be sure to check how delays will affect your mortgage application.

Enjoy this complimentary magazine, become inspired and find endless possibilities for your own inspired living.

To read the e-brochure click here.